tax liens in dekalb county georgia

How does a tax lien sale work. Investing in tax liens in Dekalb County GA is one of the least publicized but safest ways to make money in real estate.

What You Need To Know About Investing In Tax Liens Youtube

A tax lien is a claim or encumbrance placed on a property that authorizes the Tax Commissioner or the Sheriff to take whatever action is necessary and allowed by law to obtain overdue.

. Payoffs and other lien information can be viewed using the Georgia Tax. A state tax lien also known as a state tax execution is recorded with one or more Clerks of Superior Court to make it a matter of public record and to secure the debt. The system is legislatively mandated to.

The Property Appraisal Assessment. Create public. 20 Penalty Of The.

For individuals enter last name first name Display Results From optional. Under the leadership of Tom Scott deceased. Buying tax liens at auctions direct or at other sales can turn out to be awesome investments.

Investing in tax liens in Dekalb County GA is one of the least publicized but safest ways to make money in real estate. Update. View and Pay Property Tax Online.

You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you. Dekalb County GA currently has 115 tax liens available as of September 12. Choose Your Legal Category.

Select a county below and start. There are more than 8447 tax liens currently on the market. Collaborate to build.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Investing in tax liens in Dekalb County GA is one of the least publicized but safest ways to make money in real estate. Dekalb County GA currently has 92 tax liens available as of January 20.

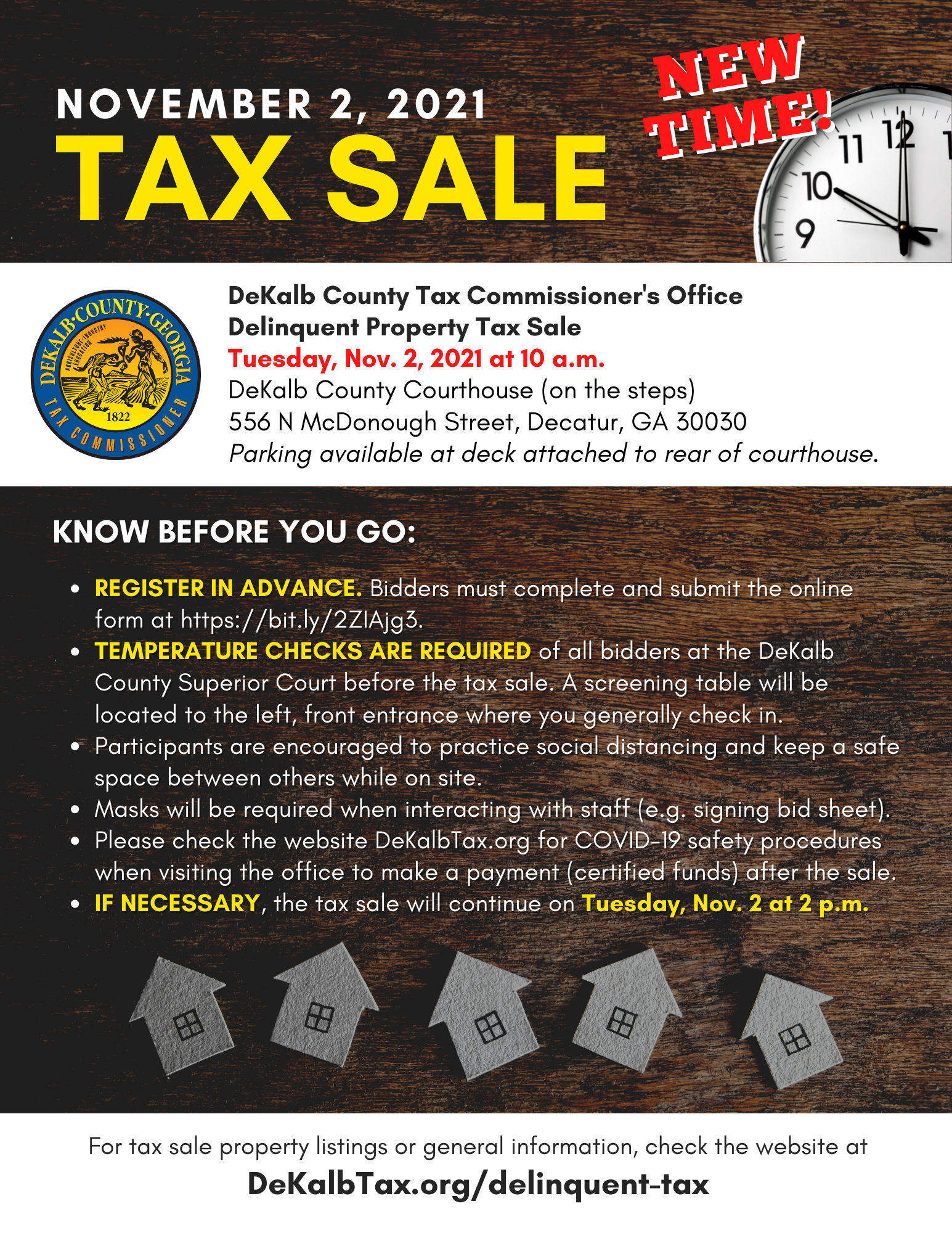

Select a county below and start. First Tuesday of every month at 1000 am. Also in the event of a foreclosure your tax lien results in you successfully acquiring the property.

Buying tax liens at auctions direct or at other sales can turn out to be awesome investments. A tax lien attaches to the property at its valuation January 1st. DeKalb County Tax Commissioner Mr.

Sign up for. Twelve 12 Months. In fact the rate of return on property tax liens investments in.

The lien is released by paying the tax charged. There are more than 8446 tax liens currently on the market. This effort will provide for public access to real estate and personal property information including liens filed pursuant to Code Section 44-2-2.

Display County Index Data Good FromThru Dates. This tool allows for. Johnson joined the DeKalb County Tax Commissioners Office in July 2000 as a Network Coordinator.

Customize your wiki your way. A tax lien against real property is superior to all other liens. Tax Deeds Hybrid Redemption.

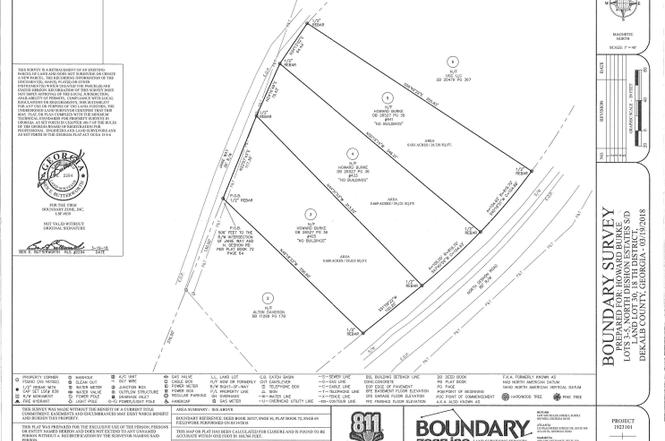

Summary of DeKalb County Georgia Tax Foreclosure Laws. Dekalb county tax sale list rom thai center. After a tax liability.

Delinquent Tax Dekalb Tax Commissioner

Learn How To Buy Tax Liens In Georgia Lien Loft

Transfer Of Tax Fifa S In Georgia Gomez Golomb Llc

Commissioner Lorraine Cochran Johnson Lorraine4change Twitter

Land For Sale Property For Sale In Dekalb County Georgia Land Com

Tax Sale Dekalb Tax Commissioner

Dekalb County Georgia Bankruptcy Lawyers Top Georgia Bankruptcy Law Firm Saedi Law Group

425 N Deshong Rd Stone Mountain Ga 30087 Mls 7088649 Redfin

Georgia S Premier Tax Sale Investing Hub Lien Loft

:quality(70)/d1hfln2sfez66z.cloudfront.net/03-16-2021/t_825be580087b4b039e3e46bc0769af9f_name_t_2c359400743c49b88d17f50b4fc217ea_name_5PP_SURPRISE_TAX_LIEN_PKG_consolidated_Video_Mixdown_4_frame_10438.jpg)

A Surprise Tax Bill You Don T Know About How One Man Almost Lost His Home Because Of It Wsb Tv Channel 2 Atlanta

Property Information Dekalb Tax Commissioner

5 Tax Sale Lists In Under 5 Minutes Youtube

Tax Sale New Time Dekalb Tax Commissioner

Dispute Over Tax Exempt Status Of Solarium Leads To Notice Of Tax Sale Decaturish Locally Sourced News

Learn How To Buy Tax Liens In Georgia Lien Loft

Dispute Over Tax Exempt Status Of Solarium Leads To Notice Of Tax Sale Decaturish Locally Sourced News