franchise tax bd co

Tax using either combined reporting or separate reporting while corporations engaged in a unitary business within and without California After briefing on the cross-motions was completed the trial court stayed the proceeding until the Fourth District decided Harley-Davidson Inc. Unity of Apportioning Pass-through Entities.

Conditional Acceptance Of Proposed Assessment

14 A130803 FRANCHISE TAX BOARD San Francisco County Defendant and Respondent.

. A State Tax Refund is taxable if you itemized deductions on that prior years federal return and took a deduction for state income taxes instead of the sale tax. Read Edward Mcroskey Etc. IN THE SUPREME COURT OF CALIFORNIA.

Changes to Franchise Tax Nexus. Did you take the Standard Deduction on your 2019 Federal return. 149 the court considered whether California could include by apportionment income of Woolworth Canada a wholly owned subsidiary of the taxpayer.

504 Given that Castle executives made up the entire Hy-Alloy board of directors Castle was effectively able to control Hy-Alloy at least with respect to major policy. Paralegal sent documents for unpaid county taxes and giving until May 20th to start payment arrangement. Thus in 1993 the Board launched an audit.

Appellee Construction Laborers Vacation Trust for Southern California CLVT was established by an agreement between construction industry employer associations and a labor union to provide a mechanism for administering. FRANCHISE TAX BD CASTTAXRFD 022117 XXXXX5 1600 022417 Is this something from my tax return. That one can potentially go for sheriff sale.

The Comptrollers office has amended Rule. A franchise tax is a state tax levied on certain businesses for the right to exist as a legal entity and to do business within a particular jurisdiction. Franchise Tax Bd 138 Cal.

Moreover the clause is only exacting in its requirements where judgments are concerned see Franchise Tax Bd. In effect it assumes that a corporation that borrows any money at all has. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web.

502 Unity of use refers primarily to the integration and control of executive forces. Franchise Tax Bd 97 CalApp2d 478 see flags on bad law and search Casetexts comprehensive legal database. Central Time shorter wait times normally occur from 8-10 am.

His regular plan out of pocket max. ISSUE Whether in a series of differing situations pass-through entity holding companies are. The California statute however pushes this concept past reasonable bounds.

For additional information see our Call Tips and Peak Schedule webpage. Petitioner Franchise Tax Board of California Board the state agency responsible for assessing personal income tax suspected that Hyatts move was a sham. I remember filing my tax return for 2015 and I had paid right on the money to CA I think I was owed a dollar or two back so.

The school and municipality are suing -1 rental is rented out and tenant is paying rent. Of Equalization 49 Cal 3d 138 146-147 776 P2d. The refund amount changing could mean that the IRS or your state adjusted your return based on information that they had that is different than what you reported.

3d 457 Brought to you by Free Law Project a non-profit dedicated to creating high quality open legal information. I know he needs to get kicked out. Just checked my bank account and apparently on 9916 I had several hundred dollars deposited into my account.

2003 108 CalApp4th 976 134 CalRptr2d 390 Farmers Bros. 2015 237 CalApp4th 193 Harley I. Total scams with this charge.

United States Supreme Court. It says FRANCHISE TAX BD DESCASTTAXRFD which google slething tells me is a CA state tax refund. Issued and whether the information sought is reasonably relevant to the duties of and intended investigation by the Tax Board see Union Pac.

913 votes and 691 voted that it is a fraud. Dont be afraid but this is a huge scam. THE GILLETTE COMPANY et al Plaintiffs and Appellants S206587 v.

3d 1154 207 Cal. FRANCHISE TAX BOARD Legal Division MS A260 PO Box 1720 Rancho Cordova CA 95741-1720. April 19 1983 Decided.

159 1983 this Court wrote that the Due. To determine whether Hyatt underpaid his 1991 and 1992 state income taxes by misrepresenting his residency. Of Tax Assessors 470 U.

While we are available Monday through Friday 8 am-5 pm. FRANCHISE-TAX-BO-PAYMENTS credit card scam it is not that rare actually to be scammed by this usual techniques when people buy online and also offline. Medical bills - pending insurance.

Franchise Tax Bd 463 U. Chase Brass Copper Co. LABORERS VACATION TRUST1983 No.

The defendant Franchise Tax Board appeals from a judgment awarding to the plaintiff Superior Oil Company a tax refund of 50264548 including interest claimed to constitute an excess levy of the corporate franchise tax for the companys fiscal year ending August 31 1952. LEGAL RULING 2021-01 SUBJECT. As a result of that decision FTB subsequently determined that these dividends should be fully.

Please have your 11-digit taxpayer number ready when you call. During Apples administrative appeal before the state Board of Equalization SBE the Second District Court of Appeal issued a decision in Farmers Bros. Franchise Tax Bd supra 10 CalApp3d at p.

Opinion for Chase Brass Copper Co. Read this carefully to recover from.

How To Pay Ca Franchise Tax Board Taxes Landmark Tax Group

Getting A Phone Call From The Ftb Lsl Cpas

California Franchise Tax Board Bank Levy How To Release And Resolve Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

California Ftb Rjs Law Tax Attorney San Diego

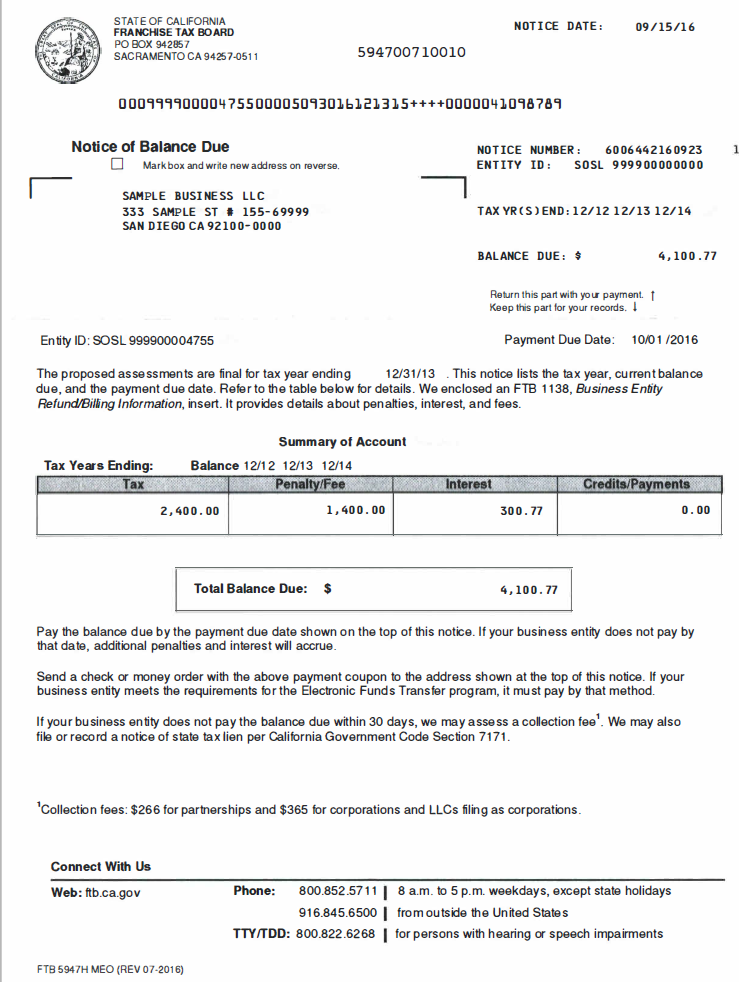

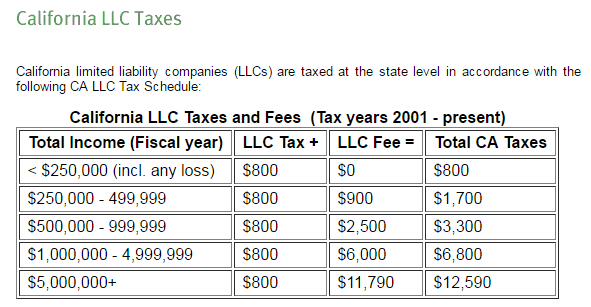

Ftb Notice Of Balance Due For Llcs Dimov Tax Cpa Services

The Limits Of Nudging Why Can T California Get People To Take Free Money Planet Money Npr

Filing A State Income Tax Return International Office

What Does Legal Order Debit Franchise Tax Board Mean Larson Tax Relief

Ftb Notice Of Balance Due For Llcs Dimov Tax Cpa Services

Stop Wage Garnishments From The California Franchise Tax Board Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

How To Speak With An Actual Representative At The Franchise Tax Board Of California Ca Ftb Quora